Will Modern Britain Ever be Able to Stop Work Completely?

We’ve done a bit of research into how modern Britain feels about their retirement, interviewing 2000 respondents of various ages.

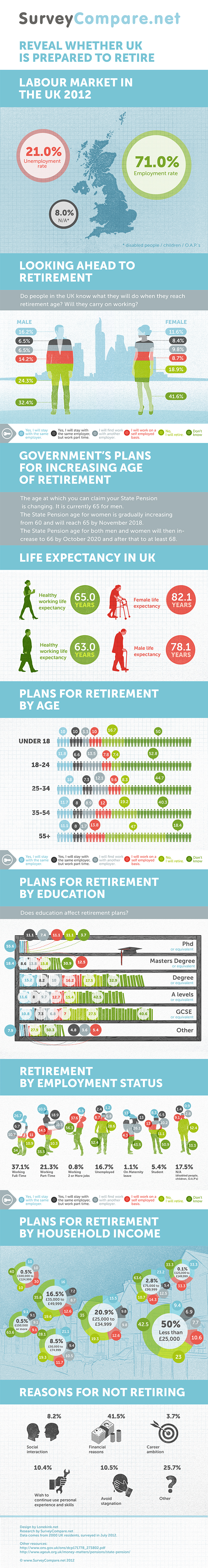

Welcome to the UK, where we work until we’re about 60 and we live until we’re about 80. Our life expectancies are rising and so is the age of pension, thanks to better health technology and a worse economy. But our expected ‘healthy’ lives - i.e the age we begin to show signs of deterioration - are not rising as sharply as the pension age. To save money the government would love us to work for longer, but is that realistic?

At SurveyCompare we welcome over 100,000 UK visitors per month. Our site is a platform for making extra money: not enough to get rich, but enough to make life a little easier. With more part time workers than ever, supplementing your income is becoming a natural way to spend free, or otherwise ‘idle’ time.

We’re aware we have users of all ages visiting our site and taking surveys: students, those with disabilities, stay-at-home mums, senior citizens. We carried out this research.

Feel free to embed the Infographic on your site:

The pension is a UK institution. What is it? An investment portfolio you contribute to throughout your earning years, so you have enough to live off when you retire. The theory is your money is invested in safe companies that aren’t likely to depreciate in value. Such as BP, which recently blew up an oil-rig, but never mind about that.

Thanks to the incentives attached to pensions, it would be a radical financial advisor who would advise against taking a pension. It’s supposed to ease retirement and require no active thought to implement. But not everyone can afford one (some senior citizens turn to home-crafts in order to make ends meet: baking, making jams, and knitting, for example.

In fact, the do-it-yourself, home-crafts lifestyle has flourished in recent years, the craft movement finding particular momentum among the younger generation who either can’t or don’t wish to find work in 9-5 business roles).

Many across the country are unemployed and have no long-term plans. It’s hard to plan for the future with no immediate source of income. Unemployment for 18 to 24 year old in the UK is currently at 21.1%. Meanwhile 71.1% are in either full time or part time work, and 8% are either too young, old, or otherwise unable to work.

Women More Uncertain Than Men (At Least in This Instance)

Our research revealed a gender difference in their expectations for the future: women seemed less likely than men to assume they’d be able to retire at the retirement age. We don’t know whether or not this is due to unequal pay or some other reason, but the difference is significant: 24.3% of men thought yes, they’d retire at the retirement age, compared to just 18.9% of women. How many admitted they simply don’t know what the future holds? 32.4% of men and 41.6% of women.

How Does Income Affect Retirement Plans?

It seemed as if those working full-time were less confident of being able to retire than those with part-time jobs, and even less confident of having enough invested than our unemployed respondents.

37.1% of our respondents work full time, and 26.7% of them plan to keep working past retirement age. Of the 21.3% working part time, 35.5% don’t know. 16.7% respondents were unemployed, of which 28.6% will retire as soon as they can, and 52.4% have no idea.

Interestingly the really high earners - the ones who in some instances could retire early - don’t seem too keen on retirement at all.

So Why do People Choose Not to Retire?

As expected we found most - 41.5% - keep working for financial reasons. 25% stipulated ‘other’ reasons, which represent personal reasons involving family investments. And roughly equal - around 10% each - stipulated the following reasons: social interaction, to exercise their skills, or to avoid personal stagnation. It turns out for some people the thought of retirement is a cause of anxiety, not security.

Please share your thoughts about retirement - whether you plan to retire or will continue working?

At SurveyCompare.net we work with people across the UK world to help them find convenient ways to earn a little extra money: through market research, freelance article writing, user testing, mystery shopping and other means.